TSMC: The fort’s second wall breached

Suppose you could get your chip designed based on ARM’s IP. Who is going to manufacture it for you? A single process shrink now costs billions of dollars – who has the financial depth to invest in process development and defray those costs over multiple customers? In comes fab vendors like TSMC.

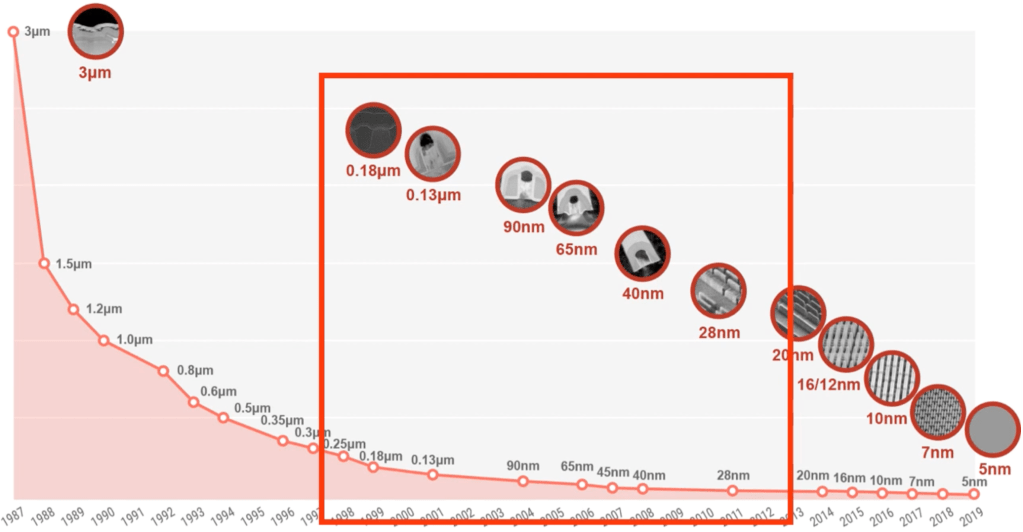

Since ’87 TSMC is a dedicated semi-conductor foundry. With most companies preferring to outsource silicon manufacturing, they developed process technologies and obtained patents in this area.

Meanwhile, in a move panned by critics, AMD, Intel’s only x86 licensee and competitor, carved out its fab into Global Foundries. They would rather focus on processor design and marketing only. Now, AMD gets its high end manufacturing done through TSMC.

The background to TSMC Apple relationship has its roots to the Apple Samsung relationship. The first iPhone in 2007 had an ARM based Samsung processor, fabbed obviously by Samsung. Apple shifted from Samsung’s ARM based processor to its own processor Apple A4 in 2010 (A4 was based on Apple’s PA Semi acquisition in 2008).

Just after that, Samsung got into the smartphone business and got into an intellectual property law suit with Apple. So, Apple got into a supply relationship with TSMC in 2014 from the A7 processor.

TSMC’s positioning is very clear. It is a semi-conductor foundry that will do contract manufacturing and will not complete with its customers. That is a position neither Samsung nor Intel could afford to take.

Apple started sourcing its most important component, the microprocessor for the iPhone from TSMC from iPhone 7. By 2016, TSMC was the sole supplier of Apple’s chips and this gave an important impetus to its R&D efforts. Funded by the revenues from Apple, they aligned their manufacturing capability to Apple’s processor roadmap.

Until the mid-2010s, Intel was the pre-eminent semi-conductor supplier funded by its PC / Server chip volumes and profits. There was no other enterprise that was comparable in terms of volume (to justify process change) and profits (to invest in the process change). The will power to invest in the next process step couldn’t have existed with anyone, as the volumes were not assured.

But, Apple’s sole supplier relationship with TSMC changed the game. With the long-term volume visibility from Apple, TSMC started investing 8.5% of its revenues in R&D spends, reaching up to USD 3.0B in 2019.

TSMC invested US$17.5B in 2020 Capex vs. Intel$15B with an announcement to hike it to $22B in 2021. TSMC is talking about ramping the 3nm production. This is by large the biggest indicator of the power of mobile volumes driving manufacturing capability. This is a competitive dis-advantage that Intel will take many years to overcome.

Over the decade ending in 2019, TSMC grew 3.5X in revenue. As of 17th Jan 2021, TSMC’s market cap is $555B (P/E: 31)vs. $235B of Intel (P/E:11).

PS: The R&D spends of Intel and TSMC are not comparable, as they classify different heads under this item. Similarly, the process capability (currently 5nm in case of TSMC) of Intel and TSMC are not comparable as they operate on different definitions.

In the PC world, it was all Intel driven. Intel will advance the design. Intel will advance the process step. The eco-system will follow with the software to leverage the capabilities. “Build”, Intel said, “they will come.”

But, in the mobile world, a golden triangle was forming since 2015. Apple set the expectations. ARM followed it up with design, Apple again used the ARM design to build the next processor generation. TSMC improved the process step. This golden triangle of Apple, ARM and TSMC was bootstrapping processor capabilities, till the singularity point, the M1. This progress was further fueled by the fact that the many Android phone vendors also leveraged the ARM for the designs and TSMC for manufacturing.

Next: Written on Rosetta Stone 10: The Desolation of the Smaug